BTC Price Prediction: Targeting New Highs Amid Institutional Accumulation

#BTC

- Technical indicators show bullish momentum with MACD positive divergence and strong support at $109K

- Institutional adoption accelerating with major treasury purchases and regulatory developments

- Market structure suggests consolidation phase likely to resolve upward toward $125K-$135K targets

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Consolidation Pattern

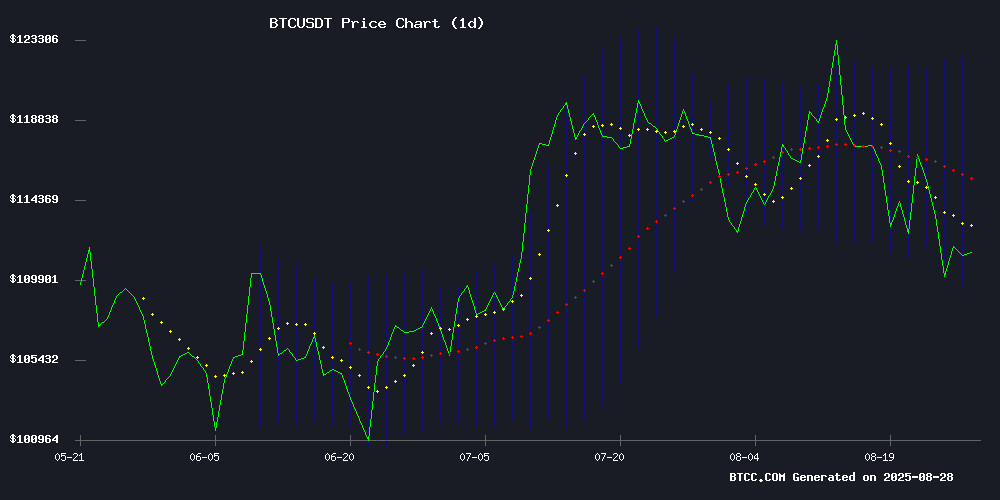

BTC is currently trading at $112,568.96, slightly below its 20-day moving average of $115,787.53, indicating a temporary consolidation phase. The MACD reading of 3439.82 versus its signal line at 1505.72 shows bullish momentum remains intact. According to BTCC financial analyst Mia, 'The price holding above the lower Bollinger Band at $109,181 suggests strong support levels. The current technical setup points toward potential upward movement once consolidation completes.'

Market Sentiment: Institutional Adoption Fuels Optimism

Recent developments including South Korea's Bitplanet establishing a $40M Bitcoin treasury and El Salvador approaching $1B in BTC reserves demonstrate growing institutional confidence. BTCC financial analyst Mia notes, 'The combination of institutional accumulation and regulatory-friendly developments, such as Trump considering crypto-friendly Fed chair candidates, creates a fundamentally supportive environment. Despite short-term profit-taking, the underlying sentiment remains strongly bullish.'

Factors Influencing BTC's Price

A New Era of Crypto Growth: Nearly Risk-Free Returns for Investors

Cryptocurrencies continue to demonstrate robust growth, with Bitcoin leading the charge. Over the past twelve months, the overall crypto market has surged by 120%, signaling strong investor confidence. For those yet to participate, the rising prices present both an opportunity and a barrier to entry.

Altcoins, while tempting, carry significant volatility risks. Many have experienced drastic declines, some to zero. The smarter alternative? Crypto mining offers a nearly risk-free avenue for substantial returns, bypassing the pitfalls of direct coin investment.

As the market evolves, mining emerges as the optimal strategy for consistent gains. With Bitcoin's trajectory pointing upward, the window for secure, high-yield opportunities may narrow soon.

Coinbase Positions Itself as Crypto-as-a-Service Leader with Institutional Focus

Eric Peters, CEO of Coinbase Asset Management, frames the firm's institutional strategy around crypto-as-a-service (CaaS) infrastructure. The acquisition of One River Digital Asset Management in March 2023 created a bridge between traditional finance and digital assets, with Peters emphasizing bilingual expertise in both worlds.

The focus lies on yield generation for crypto holders. Stablecoin and Bitcoin investors can access tailored returns ranging from 3% to over 8%, with risk tolerance dictating product structures. Coinbase's segregated business units maintain information barriers between asset management and exchange operations.

Crypto Markets Show Resilience Amid S&P 500 Rally as BTC Holds Above $113K

Bitcoin maintains its bullish stance above $113,000 as traditional markets reach unprecedented levels. The S&P 500 shattered records with a historic climb to 6,500 points, fueled by NVIDIA's strategic maneuvers in the AI chip market. CEO Jensen Huang's disclosure of negotiations with U.S. authorities regarding AI chip exports to China adds another layer to the risk-on sentiment permeating financial markets.

While the article mentions Fartcoin, no substantive developments were reported for this or other altcoins. The cryptocurrency market appears to be taking cues from equities, with BTC demonstrating particular strength during this period of macroeconomic optimism. NVIDIA's earnings report, though not flawless, provided sufficient momentum to sustain the rally across speculative assets.

South Korea’s Bitplanet Establishes First Institutional Bitcoin Treasury with $40M BTC Purchase

Bitplanet, formerly known as SGA, has emerged as South Korea's pioneer in institutional Bitcoin adoption with a $40 million treasury allocation. The move signals a strategic corporate pivot toward cryptocurrency integration, reflecting broader Asian market trends.

Paul Lee of Lobo Ventures revealed the immediate deployment of debt-free capital during Bitcoin Asia 2025, positioning BTC as the firm's primary reserve asset. This institutional endorsement arrives amid growing regulatory scrutiny across Korean crypto markets.

The rebranding from SGA to Bitplanet underscores a fundamental shift in corporate strategy. Asia Strategy Partners facilitated the transformation, betting on Bitcoin's role in next-generation corporate treasuries. Market observers note the purchase could pressure other Korean firms to consider crypto reserves.

Bitcoin Defies Whale Selling to Surge Past $113K Amid Asian Demand

Bitcoin's price rallied past $113,000 as robust demand from Asian markets overshadowed significant sell-offs by long-term holders. The BTC/USD pair climbed 1.6% to intraday highs of $113,365, according to Cointelegraph Markets Pro data. Market veteran Peter Brandt noted the move aligns with historical patterns where supply distribution often precedes market tops.

An original Bitcoin whale transferred 250 BTC ($28.2 million) to Binance, following a 750 BTC transaction the previous day. These dormant coin movements typically raise concerns among traders. The market absorbed this selling pressure while liquidating $40 million in crypto short positions during the surge.

Trump Considers Crypto-Friendly Candidates for Fed Chair Role

Eleven candidates are under review to succeed Jerome Powell as Federal Reserve chair, with at least three demonstrating favorable positions toward cryptocurrency. The selection carries significant weight, given the Fed's influence on monetary policy and market dynamics.

BlackRock's Rick Rieder, a contender for the role, has publicly endorsed Bitcoin's longevity, suggesting its potential inclusion in institutional portfolios. Federal Reserve officials Christopher Waller and Michelle Bowman have similarly acknowledged digital assets' growing role in financial systems.

The shortlist includes prominent figures such as Dallas Fed President Lorie Logan and former St. Louis Fed President James Bullard. Their stance on digital assets could prove pivotal as cryptocurrencies gain mainstream traction.

Peter Brandt Flags Critical Bitcoin Price Level Amid Whale Sell-Off

Veteran trader Peter Brandt has issued a stark warning for Bitcoin investors, identifying $117,570 as the decisive level needed to prevent a bearish double-top formation. The cryptocurrency currently hovers near $111,794 after a whale's $2.7 billion liquidation triggered a $4,000 price cascade.

Market dynamics turned volatile when an unidentified entity dumped 24,000 BTC over the weekend. Blockstream CEO Adam Back characterized the move as unusually crude for a whale transaction, noting sophisticated players typically employ algorithmic execution strategies.

Brandt maintains a neutral stance pending confirmation of either breakout or rejection at the $117,570 threshold. The chartist's analysis suggests failure to reclaim this level could validate the double-top pattern—a technical formation often preceding extended downtrends.

El Salvador's Bitcoin Reserves Near $1B Milestone as Bukele Hints at Further Accumulation

El Salvador's pioneering Bitcoin strategy continues to dominate crypto discourse as prediction markets now assign a 43% probability to the nation's reserves surpassing $1 billion by year-end. President Nayib Bukele's cryptic tweet—"I could do the funniest thing right now"—following a Kalshi market projection has fueled speculation about imminent treasury additions to the current 6,282 BTC ($700M) holdings.

The Central American nation now ranks seventh among global government Bitcoin holders, with its experimental policies including Bitcoin-backed bonds and volcano-powered mining drawing institutional attention. Polymarket data shows traders increasingly bullish on El Salvador's crypto trajectory, with September breakout odds at 16% despite broader market volatility.

Bitcoin Slides to Seven-Week Low Amid Profit-Taking and ETF Outflows

Bitcoin's price tumbled to $112,699.73, marking a seven-week low after peaking above $124,000 on August 14. The decline reflects rapid profit-taking and fragile near-term support, exacerbated by a single large transfer of 24,000 BTC that triggered $900 million in derivatives liquidations.

U.S. spot Bitcoin ETFs recorded consistent net outflows in mid-August, including a $190 million single-day withdrawal, removing a key demand pillar. Macro uncertainty and mixed Fed signals further pressured the market, with traders now eyeing $107,000 as critical support and $100,000 as a structural floor.

Bitcoin Startup Portal Secures $50M to Pioneer Trust-Minimized Cross-Chain Trading

Portal to Bitcoin, a protocol focused on enabling secure cross-chain trading with Bitcoin as the settlement layer, has raised $50 million in a funding round led by Paloma Investments. The latest capital infusion brings the project's total funding to $92 million.

The company plans to use the proceeds to expand BitScaler, its proprietary adapter designed to scale native Bitcoin transactions without relying on wrapped tokens or custodial bridges. "We want users to trade any asset, traditional or decentralized, and settle with Bitcoin-grade security," said CEO Dr. Chandra Duggirala.

Portal aims to position Bitcoin as the foundational settlement layer for tokenized markets including stocks, bonds, and stablecoins. The funding will accelerate wallet integrations and liquidity provider onboarding, with pilot programs already underway to demonstrate non-custodial swap capabilities.

Success could reshape global crypto liquidity flows by anchoring tokenized assets directly to Bitcoin's blockchain - combining the security of Bitcoin's network with the flexibility of cross-chain trading.

Trump-Backed Bitcoin Miner American Bitcoin Targets September Nasdaq Debut

American Bitcoin, a BTC mining firm 20% owned by Donald Trump's sons, is set to list on Nasdaq in September following a merger with Gryphon Digital Mining. Hut 8 CEO Asher Genoot confirmed the timeline at the Bitcoin Asia conference in Hong Kong. The combined entity will retain 98% ownership for existing shareholders.

The company launched in March with a dual strategy of mining and direct BTC purchases for its balance sheet. Its political ties through Trump Jr. and Eric Trump add a unique dimension to its market positioning. This follows another Trump-linked venture, TRUMP Media and Technology Group, announcing a crypto-focused SPAC deal earlier this week.

American Bitcoin recently secured $220 million from accredited investors, plus $10 million in BTC contributions. Funds will expand infrastructure and strengthen treasury reserves ahead of the public listing. Genoot hinted at potential international acquisitions to broaden exposure to bitcoin-linked securities.

How High Will BTC Price Go?

Based on current technical indicators and fundamental developments, BTC shows strong potential for upward movement. The MACD bullish crossover and price holding above key support levels suggest consolidation near $113K may precede another leg higher. Institutional accumulation patterns and regulatory tailwinds support a positive outlook.

| Target Level | Probability | Timeframe |

|---|---|---|

| $125,000 | High | 2-4 weeks |

| $135,000 | Medium | 4-8 weeks |

| $150,000+ | Moderate | Q4 2025 |